A Smarter Way to Access NASDAQ Index Performance

Traditional access to the NASDAQ-100 comes with limitations — broker requirements, restricted market hours, cross-border barriers, and hidden costs. NSDQ ETF COIN changes that.

It brings the familiar logic of index investing into a tokenized format that works on your terms. With NSDQ, you can gain exposure to NASDAQ performance without needing a brokerage account or relying on traditional financial infrastructure.

NSDQ ETF COIN offers global access, real asset backing, and full compliance — all delivered through a transparent, on-chain process. It’s built for investors who want efficiency, flexibility, and control without giving up quality or oversight.

Why Choose NSDQ ETF COIN Over Traditional NASDAQ Investing?

A simpler, smarter way to access index performance — built for the digital investor.

Direct Access - No Bank, No Broker

Investing in the NASDAQ or a NASDAQ ETF usually requires a traditional brokerage account. That often means paperwork, geographic restrictions, and waiting for market hours.

NSDQ removes those barriers. You can invest directly using USDT (or other supported stablecoins), from anywhere, 24/7 - without needing a bank account or financial intermediary.

It’s ideal for crypto-native investors or those outside traditional financial systems. Your money stays in your wallet until you choose to invest. And once you do, your NSDQ tokens are issued to you - no third-party custody or delays.

Greater Margin Retention

Traditional NASDAQ ETFs generate taxable events - such as capital gains distributions - even if you didn’t sell your shares. These taxes can eat into your returns, especially over time.

NSDQ ETF COIN, on the other hand, is structured to reduce such friction. As a security token held directly in your wallet, it may allow for more efficient tax treatment depending on your jurisdiction. Unlike ETFs that may distribute gains during rebalancing, NSDQ only triggers taxable events when you choose to sell.

Additionally, because you hold the asset directly on-chain, there are no recurring management fees from intermediaries - which means you keep more of your return.

Fractional,

Borderless, and Built for Everyone

Traditional ETFs often require minimum investments or come with geographic limitations. NSDQ doesn’t.

Whether you want to invest $100 or $100,000, NSDQ lets you do it — as long as you pass the required compliance checks. There are no country-specific restrictions tied to banks or brokers. All you need is a wallet and verified identity.

This opens NASDAQ-style investing to users across the globe — including those who’ve never had access to U.S. markets before.

The advantages of NSDQ

The NSDQ ETF COIN (NSDQ) ecosystem offers a wide array of advantages that elevate it compared to traditional investment options in stock indexes.

Real asset backing

Most crypto tokens derive value solely from supply and demand dynamics, but NSDQ tokens represent ownership of a real financial asset (NASDAQ ETFs shares). This anchors the token’s value to a concrete portfolio of stocks, making it a more stable and transparent investment vehicle.

Lower barriers to entry

Investing in an index ETF has multiple requirements. With NSDQ tokens, anyone with as little as $500 can get started, even without a brokerage account. This opens stock market opportunities to the “small investor” who can now participate in the NASDAQ’s growth with modest sums.

Unlimited access

Unlike stock markets that operate only during business hours, the NSDQ token can be traded 24/7 on crypto exchanges and the NSDQ web / mobile apps. Investors can thus buy or sell tokens at any time from any location, even when the NASDAQ market is closed, which makes NSDQ unique.

Liquidity and flexibility

The NSDQ token introduces liquidity features beyond a normal ETF. Investors can hold the token as a long-term investment, confident in its underlying value, but they can also react quickly to market conditions. An investor could find a buyer on crypto exchanges or via the mobile app at any time.

Tax efficiency

potential

Moving from NSDQ tokens to an existing crypto stablecoin may not trigger a taxable event in some countries, unlike selling an ETF for fiat. This means investors could rebalance in case of a bearish market or “park” gains in a stable asset without immediate tax impact, then later convert to fiat.

Compliance and security

The project is built with regulatory compliance from the ground up. Every investor undergoes Know-Your-Customer (KYC) verification and anti-money-laundering checks. Meanwhile, the actual funds and ETF shares are managed by licensed custodians and brokers for safety.

How NSDQ ETF COIN works under the hood

Step 1: Your investment is received and confirmed

Once your account is fully approved and you place an order, your investment is received through the platform and recorded in the treasury flow. This marks the start of the allocation process.

Step 2: The system executes the NASDAQ ETF purchase

After confirmation, the investment backend triggers the purchase of NASDAQ-linked ETF exposure. The goal is to put capital to work quickly instead of leaving it idle.

Step 3: The underlying ETF assets are held in regulated custody

The purchased ETF shares are held in a custodial brokerage account through a licensed custody partner. This means the token’s value is tied to real assets held under professional custody standards.

Step 4: The token reflects the value of the asset pool

Your NSDQ ETF COIN position is linked to the net asset value of the underlying ETF holdings. As the value of the ETF pool changes over time, the token value follows — and any dividends are reinvested to support long-term growth.

Resources

Read our white paper and one pager to learn more about our mission and offering.

80+

Eligible Countries

20+

Various Partners

15+

Team Members

$15M

Initial Target Goal

Our Vision in Numbers

NSDQ ETF COIN is built on strong principles and a forward-looking model. These figures reflect the structure, scale, and ambition behind the project as we prepare for long-term growth.

Built on Compliance. Backed by Code.

NSDQ ETF COIN is SEC-acknowledged and structured for auditability — with security at both the legal and technical level.

Our partners

Token sale

0x3eB6d865d407041b237E617eD5cd9A1286Da9350

Contract Address

NSDQ

Token name

Security

Token type

Ethereum

Blockchain

ERC1400

Standard

22.976.190

Total supply

16.083.333

For sale

1,00 $

Token price

15.000.000 $

Hard cap

Early investors

02.01.2026 - 28.02.2026

-

3.750.000 NSDQ

Amount

-

0,80 $

Price

-

20%

Bonus

Private sale

01.03.2026 - 30.04.2026

-

3.333.333 NSDQ

Amount

-

0,90 $

Price

-

10%

Bonus

Public sale

01.05.2026 - 30.06.2026

-

9.000.000 NSDQ

Amount

-

1,00 $

Price

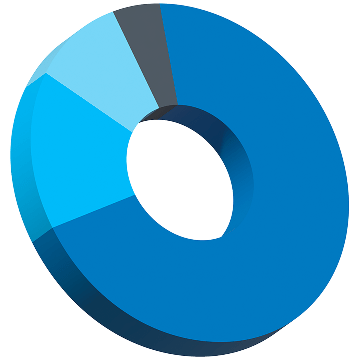

Token distribution

-

Crowdsalе — 70%

-

Reserve — 15%

-

Liquidity — 10%

-

Team — 5%

Funds distribution

-

NASDAQ ETF investments — 90%

-

Development and operational — 6%

-

Legal costs — 2%

-

Other costs — 2%

Roadmap

Team

Influencer features

Frequently asked questions

HOW MUCH MONEY IS INVESTED IN ETFs?

During the STO phase, at least 90% of everything invested is used for ETF purchases. After the STO, this jumps to up to 99%, which is very rare in the tokenization space. The reason the number isn’t exactly 100% is simply because the project has unavoidable operational costs — minting tokens, gas fees, brokerage transaction fees, custody fees, auditing, and the project’s revenue fee. These costs are normal in any regulated investment product. What’s important is that NSDQ’sstructure is designed so that almost the entire investment goes directly into real ETF assets. Once the STO ends and the ecosystem is fully set up, the backing percentage increases significantly because development expenses disappear.

What’s the minimum I can invest?

The minimum entry is $500, which is intentionally designed to be accessible. Traditional brokerage accounts often require higher minimums, and some regions don’t allow people to invest in U.S. ETFs at all. With NSDQ, you don’t need a broker,you don’t need a bank, and you don’t need to manage complicated paperwork. You can start with a relatively small amount, and because the token is fractional, even small investments give you direct exposure to the NASDAQ index. It’s meant to democratize access so anyone worldwide with KYC approval can participate.

Is the token supply fixed or can it grow?

There’s no fixed supply. NSDQ works like open-ended ETFs or mutual funds —tokens are minted on demand whenever new investments come in. This isn’t inflationary because every new token is backed by an equivalent amount of ETF assets. So even if the supply grows, no one gets diluted. There’s no arbitrary minting, no staking rewards, no emissions, and no inflation. The only driver of price changes is the performance of the NASDAQ ETFs.

Who holds the actual ETF shares? Can the team touch them?

All ETF shares are stored with a licensed custodian or regulated brokerage, not in the project team’s hands. These custodians operate under strict rules and provide security, insurance, and regulatory oversight. That means the assets backing the token are always separate from the company’s operational funds. This structure gives investors confidence because it eliminates misuse or commingling of funds.The custodian’s job is simply to hold the ETF shares safely and carry out trades when instructed.

DO INVESTORS EARN DIVIDENDS IF THE ETFs PAY THEM OUT?

NASDAQ ETFs sometimes distribute dividends. Instead of paying them out (which would complicate securities rules and lead to taxable events), NSDQ automatically reinvests all dividends into more ETF shares. This increases the NAV of the token over time, boosting the long-term value of your holdings. It’s the same strategy used by accumulating ETFs — your investment grows through both price appreciation and reinvested dividends.

What happens if the market becomes volatile?

NSDQ’s value moves with the NASDAQ index, so yes, there will be ups and downs.But historically, the NASDAQ has shown strong long-term performance, even after major corrections. Because NSDQ is backed by the biggest and most successful tech companies in the world, it often recovers when the tech sector rebounds. NSDQ also acts as a stable anchor for people in the crypto space who want something more predictable than purely speculative tokens but still want to stay inside the crypto ecosystem.

What happens if the market becomes volatile?

NSDQ is built on Ethereum, using the ERC-1400 standard — the most established and widely accepted standard for security tokens. Ethereum was chosen because it’s stable, secure, and supported by institutional-grade custody solutions. This makes NSDQ compatible with wallets like MetaMask Institutional, regulated token marketplaces, and professional asset managers. It’s the most trusted environment for tokenizing real financial assets.

How is NSDQ different from tokenized stocks?

Tokenized stocks are often synthetic and unregulated, with limited transparency or legal backing. NSDQ, on the other hand, is a regulated security token that is fully backed by NASDAQ ETFs held by licensed custodians. The project follows compliance standards such as ERC-1400, making it suitable for institutional-grade investors and retail users alike. This gives NSDQ a higher level of trust and utility.

Can I convert NSDQ into stablecoins or fiat later?

Yes, following the public sale and listing, users will be able to convert NSDQ tokens into stablecoins or fiat through participating exchanges or the project’s planned P2Pplatform. This enables convenient liquidity and flexibility for investors. Once listed,you will be able to sell your tokens 24/7, just like any other digital asset. Additionally,the project will introduce a P2P swap feature, which will allow users to exchange NSDQ tokens for stablecoins directly through the mobile app. This helps to avoid unnecessary tax events in some jurisdictions and give even more liquidity options.

How do you prevent excess token minting?

NSDQ follows a mint-on-demand model, meaning tokens are only minted after a verified investment and corresponding ETF purchase is completed. This ensures that every token in circulation is backed 1:1 by a real asset. The process is transparent and auditable, with no pre-mining or inflationary supply mechanisms. This model aligns token issuance directly with real capital inflows.

Will NSDQ Coin be available on major exchanges after the STO?

After the public STO concludes, the NSDQ team plans to list the token on regulated and compliant secondary markets that support security tokens. These listings will enable liquidity for investors and allow token holders to buy or sell NSDQ in accordance with jurisdictional regulations. More details will be shared as partnerships are finalized.

What is the difference between investing directly in NASDAQ or NASDAQ ETFs compared to NSDQ?

NSDQ is a token that mirrors the performance of the NASDAQ-100 index, similar to how ETFs work — but it’s built for blockchain investors. Traditional NASDAQ ETFs are traded through brokers, during market hours, and often require access to U.S. financial infrastructure.

NSDQ offers a tokenized version of index exposure:

- Available 24/7

- Accessible globally via stablecoins

- No bank or brokerage needed

- Tax efficiency potential

It brings the performance of NASDAQ to the digital asset world — with easier access, faster settlement, and lower entry barriers.

You can learn more about why NSDQ is a superior method to invest in NASDAQ and NASDAQ ETFs here:

What is the exact process behind NSDQ?

NSDQ is an asset-backed security token. When you invest, your funds are used to purchase exposure to NASDAQ-100 index products through licensed custodians. Your tokens represent a claim on this exposure.

The process looks like this:

- You register and pass compliance checks (KYC/AML).

- You review the investment documents (PPM, Subscription Agreement).

- You invest using the accepted currencies.

- NSDQ tokens are issued directly to your wallet.

- These tokens track the net asset value of the underlying NASDAQ exposure.

A full explanation of how you can buy NSDQ is available on the dedicated page:

Which issues is NSDQ targeting exactly, and how does it solve them?

Traditional index investing can be hard to access for global users. Banks, brokers, high minimums, and restricted access make it difficult for many to invest in U.S. markets like the NASDAQ-100.

NSDQ solves this by:

- Offering a compliant, blockchain-native token

- Lowering the entry threshold

- Enabling stablecoin investment

- Providing borderless access

- Giving crypto-native investors a familiar, flexible asset

It makes index investing easier, faster, and more inclusive — without replacing the index itself.

How do investors benefit with NSDQ?

With NSDQ, investors get:

- Exposure to NASDAQ-100 performance

- No traditional broker or banking friction

- Access via both crypto and fiat

- 24/7 access to view, hold, or (in the future) trade tokens

- Transparent token mechanics and audited flows

- Compliance and security aligned with investment-grade standards

- Tax efficiency potential

It’s a way to bring traditional index logic to the digital asset economy — while keeping your capital in your wallet.

Is the NSDQ token audited and regulated? What protects my investment?

Yes. The NSDQ ETF COIN is structured as a security token and operates under a regulated framework to protect investors. Out smart contract has been audited and officially certified.

The token is acknowledged by the U.S. Securities and Exchange Commission (SEC) under Regulation D and Regulation S. This acknowledgement ensures that the offering follows established legal and compliance standards for security offerings, including proper disclosures, investor protections, and eligibility criteria.

Investors complete identity verification (KYC/AML) and sign legally binding agreements before any tokens are issued. The funds raised are used to gain exposure to NASDAQ-100 index assets via licensed custodians. Your NSDQ tokens represent a direct claim on that exposure.

Additionally, the structure is supported by independent audits and legal oversight. Every part of the process — from token issuance to custody — is designed to provide security, transparency, and compliance.

You can check our technical audit and our SEC acknowledgement documentation via the links below.